How living a Healthier lifestyle can save money

Author: Eliza Graham | August 18th, 2017

A healthy lifestyle involves a balanced diet, regular exercise and effective stress management. Making these healthy choices can affect more than just your physical appearance -- it can also increase both the length and quality of your life by boosting your immune system and keeping you emotionally healthy. I guarantee you will save money too.

Mental Health

I don’t understand why people don’t consider their mental health. There are so many misconceptions about this subject that I think everyone should read an article or two about mental health. Mood and cognitive function play a massive part in your quality of life, productivity and healthy interpersonal relationships. While more research is needed scientists say a balanced diet is an effective way to protect mental health.

Energy and Stamina

Health is more than just not being ill. A healthy body rewards you with a lifetime of service by giving you high energy, strength and surviving much longer. Low-intensity exercise can decrease fatigue by 65% percent while boosting energy levels by up to 20%!

Disease Prevention

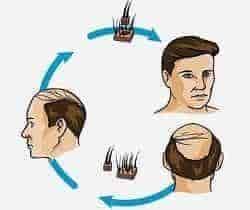

Beauty and Appearance

Living a healthy lifestyle is vital for maintaining a youthful and attractive appearance. So, for example, you need Vitamin A as it supports healthy skin, hair and nails.

Less Premiums

Living a healthy lifestyle also helps you save money too. Giving up things like Smoking, Alcohol and losing weight can save you a lot of money. Did you know if you pay for Life Insurance or Mortgage insurance you can be paying up to double in premiums if you smoke, drink a lot of alcohol or fit into the obese category?

This is because you pose a higher risk to the insurance companies because there's more of a chance they will need to pay out. This is because the three factors I listed above bring many potential health problems that can lead to a payout. Insurance companies class you as a smoker if you have touched nicotine in the past 12 months.

Aside from paying more premiums on insurance, you will save a tonne by cutting out smoking, stopping drink and losing weight. Shop around for life insurance and you will find it cheaper too. Life insurance and mortgage protection gives you the peace of mind you need and can reduce stress during hard times. Places like hello.ie are great for finding the cheapest deals. Live healthy to save money, how to save money by living healthy

Lifestyle changes are easy for the most part you just need to be consistent and eventually it will become a routine. Certain changes are harder than others but small changes here and there can be made.

So, for example, most of us don’t drink enough water every day even though water is essential for our bodies to function. Water is needed to carry out body functions and remove waste but we don’t feel the need to drink more! I find that pretty crazy, so the biggest tip and easiest one to do is drink a couple more glasses of water a day.

Stopping smoking can be quite challenging but there are plenty of support communities online that can help. Most people can take between 3 and 4 times before they eventually quit.

*****

.jpg)